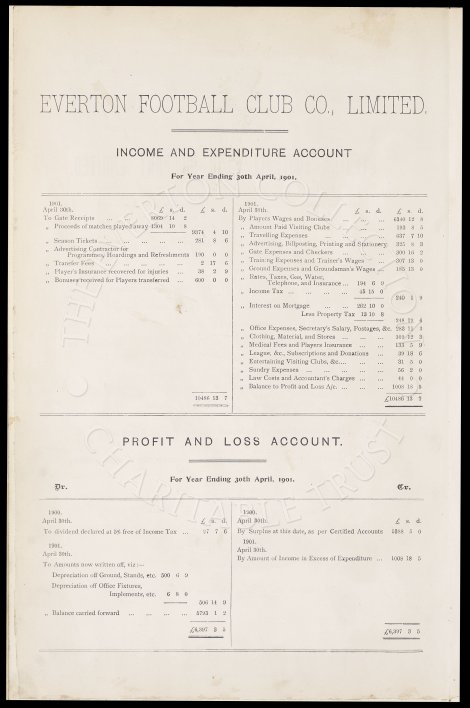

EVERTON FOOTBALL CLUB CO., LIMITED.

INCOME AND EXPENDITURE ACCOUNT

For Year Ending 30th April, 1901.

1901 1901.

April 30th £ s. d. £ s. d. April 30th. £ s. d. £ s. d.

To Gate Receipts ... ... ... 8069 14 2 By Players Wages and Bonuses ... ... ... 6340 12 8

" Proceeds of matches played away 1304 10 8 " Amount Paid Visiting Clubs ... ... ... 193 8 5

----------- 9374 4 10 " Travelling Expenses ... ... ... ... 637 7 10

" Season Tickets ... ... ... ... ... 281 8 6 " Advertising, Billposting, Printing and Stationery 325 8 3

" Advertising Contractor for " Gate Expenses and Checkers ... ... ... 300 16 2

Programmes, Hoardings and Refreshments 190 0 0 " Training Expenses and Trainer's Wages ... 307 13 0

" Transfer Fees ... ... ... ... ... ... 2 17 6 " Ground Expenses and Groundsman's Wages ... 185 13 0

" Player's Insurance recovered for injuries ... 38 2 9 " Rates, Taxes, Gas, Water

" Bonuses received for Players transferred ... 600 0 0 Telephone and Insurance... 194 6 9

" Income Tax ... ... ... ... 45 15 0

---------- 240 1 9

" Interest on Mortgage ... ... 262 10 0

Less Property Tax 13 10 8

---------- 248 19 4

" Office Expenses, Secretary's Salary, Postages, &c. 283 11 3

" Clothing, Material, and Stores ... ... ... 109 12 3

" Medical Fees and Players Insurance ... ... 133 5 9

" League, &c., Subscriptions and Donations ... 39 18 6

" Entertaining Visiting Clubs, &c.... ... ... 31 5 0

" Sundry Expenses ... ... ... ... ... 56 2 0

" Law Costs and Accountant's Charges ... ... 44 0 0

" Balance to Profit and Loss A/c. ... ... ... 1008 18 5

-------------- --------------

10486 13 7 £10486 13 7

-------------- --------------

PROFIT AND LOSS ACCOUNT.

Dr. For Year Ending 30th April, 1901. Cr.

1900. 1900.

April 30th. £ s. d. April 30th. £ s. d.

To dividend declared at 5% free of Income Tax ... 97 7 6 By Surplus at this date, as per Certified Accounts 5388 5 0

1901.

1901. April 30th.

April 30th. By Amount of Income in Excess of Expenditure ... 1088 18 5

To Amounts now written off, viz:-

Depreciation off Ground, Stands, etc. 500 6 9

Depreciation off Office Fixtures,

Implements,etc. 6 8 0

--------- 506 14 9

" Balance carried forward ... ... ... ... 5793 1 2

------------- --------------

£6,397 3 5 £6,397 3 5

------------- --------------